Table of Contents

** Minutes

3 things you should know about Section 321 for ecommerce

How ShipBob adapted to the Section 321 suspension

Post-Section 321 fulfilment strategies

For years, ecommerce businesses prioritized minimising logistics costs to maximise revenue. Section 321 provided a crucial advantage by allowing low-value shipments to bypass taxes and import duties. However, the landscape has dramatically changed in 2025.

Through a series of executive orders beginning in February 2025, the US government has now decided to fully suspend the de minimis exemption under Section 321. What once allowed duty-free imports for shipments valued at $800 or less has been eliminated, first for China-origin goods, then globally as of August 29, 2025.

This guide examines the end of Section 321, its implications for your business, and how ShipBob’s fulfilment strategies can help you maintain compliant, cost-effective operations in this new regulatory environment.

Note: This article is solely for informational purposes and does not constitute legal advice.

What is Section 321?

Section 321 was a US Customs and Border Protection (CBP) shipment type that allowed goods to clear through US customs tax and duty-free. The section exempted low-value shipments from taxes and duties as long as the shipment complied with the de minimis threshold of $800 or less.

As of August 2025, CBP has fully suspended the de minimis exemption, ending duty-free entries for all shipments under Section 321, regardless of value.

How did Section 321 work?

Before its suspension, Section 321 operated under these principles:

- Goods below the de minimis value could be imported into the US without duties and taxes

- Simplified customs process with reduced paperwork requirements

- Faster clearance times for qualifying shipments

- Daily shipment limits per consignee

The suspension timeline unfolded rapidly in 2025:

- February 2025 – May 2, 2025 – The de minimis exemption for goods originating in China and Hong Kong under Section 321 was officially eliminated.

- July 30, 2025 – The President signed an executive order to suspend the de minimis exemption globally, extending beyond just China/Hong Kong.

- August 29, 2025 – The global suspension takes effect, meaning all imports, regardless of value or country of origin, are now subject to duties, taxes, and full customs processing.

This complete elimination means that all imports, regardless of value or origin country, now face standard duty and tax requirements, fundamentally changing the cross-border ecommerce landscape.

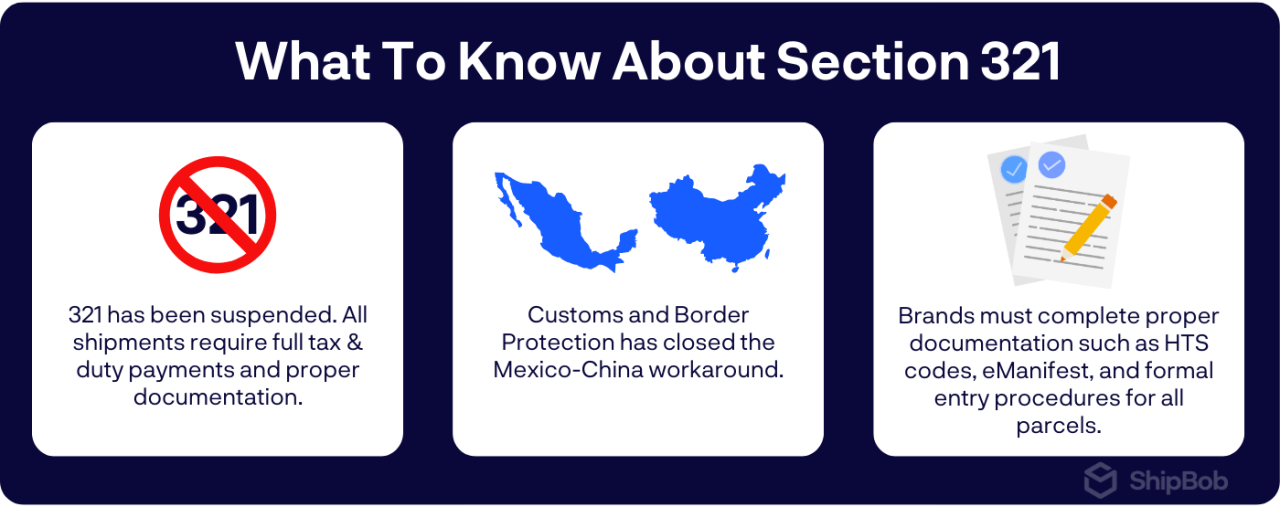

3 things you should know about Section 321 for ecommerce

Part of the Tariff Act of 1930, Section 321 helps ecommerce businesses save on importing costs for shipping products to the US. While brands can bypass taxes and duties and their shipments receive clearance quicker with less paperwork, it’s a nuanced program with complex guidelines and regulations.

Here are some rules and conditions that apply to Section 321 that you should be aware of.

US customs laws and regulations

While Section 321 is no longer in effect, understanding the changes, and how they’re being enforced, is critical for staying compliant in 2025 and beyond. Here’s what merchants need to know:

1. The de minimis threshold is no longer in effect

The $800 threshold that once defined Section 321 eligibility has been completely eliminated. All shipments entering the US now require:

- Full duty and tax payments based on product classification

- Formal customs documentation regardless of value

- HTS (Harmonized Tariff Schedule) code classification for every item

- Complete commercial invoices with accurate valuations

Even items valued at $10 or $50 face the same customs requirements as higher-value goods, significantly impacting small-parcel economics and requiring businesses to recalculate their landed costs entirely.

2. No China-Mexico workaround

In previous years, some merchants tried to route China-origin goods through Mexico to take advantage of Section 321’s threshold and avoid Section 301 tariffs. CBP has now closed this loophole; transshipments from Mexico containing Chinese-origin goods are flagged, inspected, and charged full duties. Attempting this can result in penalties and shipment delays.

3. Greater documentation & customs scrutiny

With de minimis gone, customs documentation is more important than ever. Merchants must now:

- Provide complete and accurate HTS codes for each item.

- Use eManifest for all shipments.

- Adhere to formal entry procedures, even for small parcels.

The Department of Justice has signaled that tariff enforcement is likely to surge, with trade and customs fraud (including tariff evasion) now a high enforcement priority. This means increased scrutiny on valuation, classification, and origin declarations.

Working with a fulfilment partner that automates customs paperwork can help mitigate risk and speed up processing.

How ShipBob adapted to the Section 321 suspension

ShipBob has rapidly evolved its services through the De Minimis Defense Program to help merchants navigate the post-Section 321 landscape. Our comprehensive response leverages our expansive network of 60+ fulfilment centres and technology to maintain efficient, compliant fulfilment despite the regulatory changes.

Canada hubs

ShipBob’s strategic Canadian fulfilment centres near Toronto and other major cities have become essential components of our cross-border solution. These facilities provide an average 2-3 day transit times to East Coast destinations while offering streamlined logistics.

By leveraging these Canadian operations, merchants can reduce their dependency on direct China-to-US shipping routes and take advantage of CUSMA (formerly USMCA) trade agreement benefits.

Automated allocation & eManifest

ShipBob’s proprietary technology has been enhanced to handle the complex requirements of post-Section 321 commerce. The system intelligently routes orders to optimal fulfilment locations based on compliance requirements while automatically generating CBP-compliant electronic manifests for every shipment.

Before any package leaves our facilities, our platform validates HTS codes and duty calculations, ensuring accuracy in documentation across multiple jurisdictions.

Injection into U.S. domestic network

Once cleared through customs, packages seamlessly enter ShipBob’s extensive US carrier infrastructure and benefit from:

- Direct injection into USPS, UPS, and FedEx networks

- Domestic shipping rates and delivery speeds

- No additional customs delays for end customers

- Full tracking visibility from fulfilment to delivery

This integration means that despite increased border complexity, your customers still receive the fast, reliable delivery they expect.

Foreign-Trade Zone (FTZ) warehouses

ShipBob has added 2 Foreign-Trade Zone (FTZ) warehouses to its fulfilment network. These warehouses are located on the West and East Coasts near our Hub sites.

FTZ warehouses enable the deferring of duties on imported goods, simplifying logistics and optimising cash flow. With FTZ warehouses, brands can store domestic and international inventory together indefinitely.

Post-Section 321 fulfilment strategies

With Section 321’s elimination, merchants must evaluate alternative fulfilment approaches to manage the new reality of added duties, taxes, and documentation requirements. Each strategy offers different benefits depending on your product mix, customer base, and operational priorities.

The table below compares four key approaches to help you identify which strategies align with your business needs, followed by detailed explanations of how ShipBob supports each one.

| Strategy | Best for | Key benefits | Considerations | ShipBob support |

| U.S. domestic centres | High-volume sellers, fast-shipping requirements | • 1-3 day delivery • No per-order duties • Simplified returns | Higher upfront inventory investment | 60+ US fulfilment centres with strategic placement tools |

| Bonded/FTZ warehouses | International sellers, seasonal businesses | • Deferred duty payments • No duties on exports • Better cash flow | Requires FTZ compliance knowledge | FTZ facilities with guided setup and management |

| Sourcing diversification | Tariff-sensitive products, risk mitigation | • Lower duty rates • Supply chain resilience • New market access | Supplier vetting and relationship building | Global fulfilment network across multiple continents |

| Pricing recalibration | All businesses post-Section 321 | • Maintained margins • Competitive positioning • Customer retention | Requires market analysis and testing | Cost forecasting tools and Inventory Placement Program |

Fulfilment from U.S. domestic centres

Storing inventory within the US eliminates customs friction entirely by consolidating duties into a single, predictable wholesale import cost rather than variable per-shipment charges. This approach enables 1-3 day shipping to most US addresses. The domestic model also simplifies returns management and eliminates customs complications.

With ShipBob’s 50+ US fulfilment centres and Inventory Placement Program, strategic inventory placement can offset increased duty costs through reduced shipping expenses and improved conversion rates from faster delivery. Our omnichannel fulfilment capabilities also ensure that the same strategically placed inventory can serve DTC, retail, wholesale, and marketplace orders from a single network.

Bonded vs non-bonded warehousing

Bonded warehouses let you store imported goods without paying duties until they’re shipped to U.S. customers. In contrast, non-bonded warehouses require you to pay duties as soon as the goods enter the U.S.

ShipBob offers Foreign Trade Zone (FTZ) warehouses, which work similarly to bonded warehouses but with extra advantages. In an FTZ, you can delay duty payments until your products are sold into the U.S., which helps with cash flow, especially for seasonal businesses. If products are exported to another country or destroyed, you don’t pay any duties at all. Manufacturers can also benefit from “inverted tariffs,” where the duty rate on the finished product is lower than on the imported parts.

FTZ facilities are a great fit for businesses that sell internationally or import components for U.S. assembly.

Sourcing diversification away from China/Mexico

The suspension of Section 321 has accelerated manufacturing diversification. Vietnam, India, and Southeast Asian countries often offer lower tariffs on many product categories. Nearshoring to Central and South American suppliers reduces transit times, while European partnerships provide access to different trade agreements.

Some businesses, like Apple, are even evaluating domestic US manufacturing for high-margin products, finding that eliminating customs complexity and reduced lead times can offset higher production costs. ShipBob’s global fulfilment network supports these strategies with facilities across multiple continents.

Pricing and landed-cost recalibration

The end of Section 321 demands a comprehensive pricing reassessment beyond simply adding duty costs. Understanding true landed costs for every SKU enables strategic decisions; some businesses absorb costs on key products while passing them through on others.

Implementing minimum order values helps maintain margins, while product mix optimisation shifts focus toward items with favorable duty rates.

Get in touch with ShipBob for compliant fulfilment support

ShipBob’s comprehensive suite of services addresses every challenge created by Section 321’s suspension, providing the expertise and infrastructure needed for successful adaptation. We understand that this regulatory shift represents one of the most significant changes to cross-border commerce in recent years, and we’ve built our response accordingly.

Rapid tariff impact forecasting & cost insights

Understanding your new cost structure is the critical first step in adapting to the post-Section 321 environment. Our proprietary forecasting tools deliver personalised landed cost analysis for your business. We calculate duty and tax obligations based on current CBP rates while modeling various sourcing and routing options to identify the most cost-effective approach for your business.

This quick-turn assessment enables rapid decision-making, helping you adjust strategies before competitors and maintain market position.

HS code mapping & customs documentation support

Accurate customs documentation has never been more critical. ShipBob’s customs expertise ensures smooth border crossings through professional HS code classification for every SKU in your catalogue . Our systems automatically generate eManifest documentation that meets CBP standards while preparing commercial invoices with all required data elements.

We also handle country of origin documentation and keep everything up to date with changing regulations.

Strategic inventory positioning & fulfilment optimisation

The new regulatory environment makes strategic inventory placement more important than ever. ShipBob’s network enables geographic distribution that balances inventory across the US, Canada, and other international facilities based on your specific needs. We use demand-based allocation to position products near your customers, reducing shipping costs and delivery times while managing duty exposure.

Our multichannel logistics capabilities coordinate inventory across DTC, retail, and marketplace sales, ensuring consistent availability no matter how customers shop. Seasonal adjustments allow for dynamic rebalancing based on demand patterns, while our distributed model provides risk mitigation by avoiding single points of failure in your supply chain.

On top of that, our Inventory Placement Program, available for US operations, uses machine learning to continuously optimise your inventory distribution for both cost efficiency and delivery speed.

Leveraging Foreign Trade Zone (FTZ) warehouses

ShipBob’s FTZ facilities offer sophisticated duty management strategies that go beyond simple storage. Within these zones, you can store inventory without immediate duty payment, maintaining flexibility to process orders with optimised duty timing.

Products that are ultimately exported or destroyed benefit from complete duty elimination, while the zone structure allows you to maintain flexibility for international order fulfilment without triggering US duty obligations.

Our team provides comprehensive guidance through FTZ qualification, helping determine the optimal mix of FTZ and standard warehouse usage for your specific business model.

Dedicated supply chain architecture consultation

Every business faces unique challenges in the post-Section 321 world, which is why ShipBob offers dedicated consultative services. Our Supply Chain Architecture Team begins with a comprehensive assessment of your product categories and their specific tariff exposure, analising your destination markets and customer expectations to design appropriate service levels.

We evaluate risks across your entire supply chain and develop mitigation strategies, creating custom logistics architectures that align with your business objectives. This includes integration recommendations for your existing tech stack, ensuring seamless data flow between systems.

Our experts bring deep knowledge across operations, technology, and retail compliance, designing solutions tailored to your specific needs rather than forcing you into a one-size-fits-all model.

24-hour onboarding & merchant support access

Speed matters when adapting to regulatory changes, which is why ShipBob commits to 24-hour quote turnaround for pricing and solution proposals. Our expedited onboarding process gets you operational quickly, with streamlined procedures that don’t sacrifice thoroughness for speed. Once live, you have access to 24/7 Merchant Care through chat, phone, and email channels, with support teams positioned globally to ensure someone is always available.

Your dedicated account management team provides personalised guidance through the transition, helping navigate challenges as they arise. Whether you’re transitioning from another provider or establishing new fulfilment operations, ShipBob’s support infrastructure ensures smooth implementation and ongoing success in this new compliance landscape.

Section 321 FAQs

Section 321 is something that every global ecommerce business should be aware of. Here are some answers to some of the most common questions about Section 321.

How has U.S. Section 321 de minimis duty-free relief changed for China- and Hong Kong-origin goods as of May 2, 2025?

As of May 2, 2025, all goods originating from China and Hong Kong lost de minimis exemption privileges entirely. This means that regardless of value, even items worth just $1, full duties and taxes apply. The change eliminated what was once a significant advantage for small-value shipments from these regions, requiring complete customs documentation and payment of all applicable tariffs, which can range from 7.5% to 25% depending on the product category.

What implications does the global sunset of the $800 de minimis exemption have, starting August 29, 2025?

The August 29, 2025 global suspension extends the duty requirements to all countries, not just China and Hong Kong. This means every international shipment entering the US, regardless of origin or value, now requires full customs processing, duty payments, and formal documentation. The impact includes increased costs for consumers, longer processing times at borders, fundamental changes to cross-border ecommerce economics, and the need for businesses to completely restructure their pricing and fulfilment strategies.

How can ShipBob support brands with customs automation, accurate HTS code classification, and compliance workflows?

ShipBob provides comprehensive customs support through automated tools that generate compliant documentation, validate HTS codes before shipping, and keep tariff data up to date. We collaborate with customs brokers to help streamline the clearance process, while our team offers guidance on classification issues and evolving regulations.

How does ShipBob help brands impacted by the elimination of Section 321?

As countries reduce or eliminate de minimis thresholds, ShipBob helps brands stay compliant, improve operations, and deliver a seamless international experience.

Brands can leverage the following capabilities through our De Minimis Defense Program:

- Foreign-Trade Zone warehouses – Store inventory in ShipBob’s two US FTZ facilities to defer or reduce duties and optimise cross-border fulfilment.

- Global network of 60+ fulfilment centres – Distribute inventory across ShipBob’s warehouses in the US, EU, UK, Canada, and Australia to ship locally.

- Duty & tax management – ShipBob integrates with landed cost tools to help calculate duties and taxes upfront, reducing cart abandonment and compliance risk.

By combining FTZ solutions, localised fulfilment, and tax management, ShipBob helps brands maintain margins and scale globally despite Section 321 being eliminated.

How can US-based fulfilment or Foreign Trade Zone warehouses help brands minimise surprise duties under new Section 321 regulations?

US-based fulfilment consolidates duty payments at the import level rather than per-shipment, providing predictable costs and eliminating surprise charges for customers. Foreign Trade Zone warehouses offer additional flexibility by deferring duties until goods enter US commerce, potentially eliminating duties on exported items, and allowing you to choose the most favorable duty treatment. Both strategies provide cost predictability and cash flow advantages compared to individual shipment duties.

How will the phase-out of de minimis exemptions impact small parcel pricing and fulfilment strategies?

The elimination of de minimis exemptions fundamentally changes small parcel economics by adding fixed customs costs to every international shipment, making low-value orders potentially unprofitable. Businesses must now consider strategies like minimum order values, bundled shipping, domestic fulfilment to avoid per-order duties, and adjusted pricing to maintain margins.