Table of Contents

** Minutes

The importance of cost per unit

How to calculate cost per unit?

Cost per unit vs. price per unit

5 ways to reduce your cost per unit

Greg’s Apothecary produces scented candles for an average of $10 per unit. It costs Greg’s biggest competitor $8 on average to create a similar candle.

While Greg can mark up the price of his candles (charging customers more than his competitor), he knows he should identify ways to reduce his costs to have a healthier margin.

For Greg and many other retail businesses, success is heavily reliant on having a profitable cost per unit — and half of that battle is keeping your costs low.

Only when you know how much it costs to produce or procure a single unit of any SKU can you make more informed decisions on how much to sell it for. This is why ecommerce companies that sell their own goods must calculate and monitor their cost per unit over time.

By keeping the cost per unit low, you can pass on the savings to the customer and entice more customers to buy (or take home more money if you’re able to sell it at a premium).

In this article, we will define cost per unit, explain why it is important, show how to calculate it, and offer actionable tips to reduce your cost per unit.

What is cost per unit?

Cost per unit refers to both the variable costs and fixed costs associated with producing and delivering a single unit of any product to an end consumer. Monitoring your cost of goods sold helps create context to set pricing and ensure profit is generated.

The importance of cost per unit

Cost per unit identifies the relationship between production costs, logistics costs, and gross profits. For ecommerce businesses especially, it is used to to set a pricing strategy after evaluating the cost of:

- Manufacturing and supplier costs

- Marketing and sales

- Warehousing and storage

- Fulfilment and shipping

Additionally, a lower cost per unit can also identify gaps in internal efficiencies.

Reflects efficiency of your business

Cost per unit offers insight into how much it costs to produce a single item, receive new inventory, store it, and fulfil and ship it. By breaking down the cost per unit, you can identify inefficiencies that are driving up costs, therefore reducing profit margins.

A low per-unit cost is an indicator of efficient production and logistics, which ensures profit is being made per sale. Of course, quality plays a role, as higher quality or premium goods typically cost more to produce than less durable or cheaper materials.

Helps correctly price your SKUs

Calculating cost per unit is also important, because it gives ecommerce companies an idea of how much they should charge for each of their products to be profitable.

It’s important to keep a couple things in mind:

- Consistently evaluate cost per unit, especially since variable costs fluctuate — costs such as raw materials, packaging, and shipping can increase at any time.

- Understand the role volume plays — economies of scale and higher volumes (of units purchased from a manufacturer, shipments shipped with a courier) often come with discounts, which can ultimately help reduce the cost per unit.

It is best to have a relatively low cost per unit, as long as the quality and sustainability standards are maintained. This way, you can price your goods competitively, and still secure decent sales margins.

How to calculate cost per unit?

Wondering how to calculate cost per unit? Fortunately, there’s a simple formula that is easy to use. You can use the calculator below for a simple calculation.

Calculator: Cost Per Unit

Enter the values below, and hit “Calculate” to find your average cost per unit.

Note: This calculator displays the final value in $ but works for any currency.

To break this down even further, we can walk through some examples. As you can see from the calculator above, calculating cost per unit includes a few main components. Here is a breakdown.

Cost per unit formula

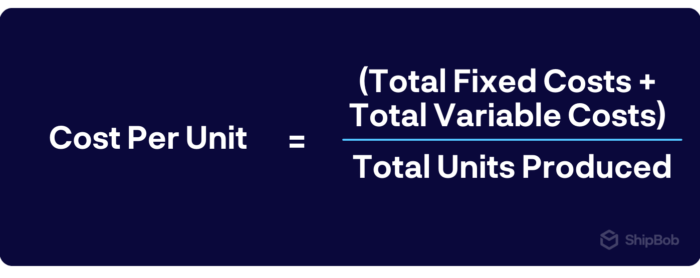

The cost per unit formula involves the sum of fixed and variable costs, which is then divided by the total number of units manufactured during a period of time. Here is how to find the cost per unit:

Cost per unit = (Total fixed costs + Total variable costs) / Total units produced

But to accurately calculate cost per unit, it’s important to understand what is considered fixed costs versus variable costs. Here is an overview.

1. Total fixed costs

Total fixed costs remain the same, no matter how many units are produced in a time period. Examples of fixed costs include rent, salaries, and overhead. These fixed costs are easy to forecast and budget for.

Total fixed cost = Building rent + Direct labour costs + Other fixed costs

2. Total variable costs

Variable costs can change at any time. The number of units sold within a specific period of time can also impact these costs. Examples are production costs, customer acquisition, packaging, and shipping costs.

Total variable cost = Production costs + Customer acquisition costs + Packaging costs + Shipping costs + Other variable costs

Cost per unit example

Take the case of a small ecommerce business called PetsCo, which produced 100 units of an 80 lb bag of premium dog food in February 2022.

In terms of salaries, rent, and other overhead, their monthly fixed cost of production is $5,000.

In February 2022, the variable cost incurred was $3,000, which includes raw materials, electricity, and labour.

Cost per unit = (Total fixed costs + Total variable costs) / Total units produced

Cost per unit = ($5,000 + $3,000) / 100 = $80

Therefore, the cost to produce one unit of their very large dog food in February 2022 was $80.

Now, if PetsCo wishes to make a 10% profit margin on the merchandise, it needs to mark up the selling price accordingly.

Cost per unit + Profit percentage = Selling price

$80 + (10% of $80) = $88

$80 + $8 = $88

So, the business needs to sell the goods at $88 to be profitable at their desired margin. Note: Many business often want a much higher profit margin than 10%.

Cost per unit vs. price per unit

While the cost per unit refers to how much you spend to deliver one unit, the price per unit refers to how much you charge customers for each item sold.

Below is how the relationship between these two metrics affects profitability:

- Break-even point is attained when cost per unit = price per unit

- Profit is secured when cost per unit < price per unit

- Loss is incurred when cost per unit > price per unit

To calculate the profit or loss per unit, you will need to find the difference between the cost and unit price.

Continuing with the PetsCo example, here is how you arrive at the profit per unit, where:

- The cost per unit = $80

- The price per unit = $88

Profit per unit = Price per unit – Cost per unit

$88 – $80 = $8

5 ways to reduce your cost per unit

A high cost per unit means that your product pricing must be higher to accommodate desired company profits. Keeping average order value in mind, many businesses try to find ways to entice customers to spend more money in a single purchase (through bundles, discounts, and other incentives).

While you can always try to get customers to spend more (or you can charge them more money), the root cause of low margins is often high costs for the business.

Depending on the various factors that affect the cost per unit, there are different ways of reducing fixed and variable costs in your ecommerce operations. Below are a few ways to address the issue of a high cost per unit.

1. Optimise your logistics strategy

One of the most efficient ways to reduce costs is to focus on reducing logistics costs. Improving supply chain efficiency can help you significantly reduce:

- First-mile delivery costs (by shortening the distance between supplier and distribution centres)

- Storage costs (by optimising warehousing efficiency and only storing what you need to meet demand)

- Fulfilment costs (by automating processes or partnering with a 3PL like ShipBob)

In turn, this can help you deliver orders to customers more affordably while keeping product prices competitive.

“We love that ShipBob allows us to keep low overhead by not having to do shipping ourselves.

Having the ability to outsource that to a third party logistics company that could provide us affordable pricing, customer service, and a software platform that was really intuitive that was linked to our website and all the rest of our platforms, giving us all those real time insights — it was a game changer.”

Nathan Garrison, Co-Founder and CEO of Sharkbanz

2. Reduce material costs

Spending less money on material costs, which tend to account for a majority of production costs, can obviously reduce cost per unit. You can do so by optimising product sourcing, finding lower-cost manufacturers, and/or finding suppliers located closer to you.

Procurement logistics and freight shipping costs also need to be evaluated to ensure finished goods are being received at the lowest costs.

For example, working with a wholesale distributor will likely offer you better rates for inventory replenishment.

Thanks to greater volume discounts, or economies of scale (as your unit volumes increase), the average unit cost also reduces. Many times, suppliers and wholesalers require a minimum order quantity per inventory run, but if you’re able to invest in more inventory upfront, you may get further discounts (this of course requires more working capital and a high degree of confidence you won’t have obsolete inventory that expires too quickly).

3. Reduce holding costs

Any expense incurred in the storage of unsold inventory is referred to as holding costs. These costs can range from warehousing to labour costs, to depreciation and opportunity costs.

Businesses often overpay for storage they don’t need, unnecessarily inflating their inventory holding costs.

To bring down holding costs, it might be worth implementing a warehouse management system, using methods like warehouse slotting to optimise space, or partnering with a 3PL (even for just your highest-selling items if you have a large product catalogue or SKU count) that can significantly drive down storage costs instead of leasing your own warehouse.

“Overall, there is more transparency with ShipBob that even helps our team manage customer service better. I can see the granular stage the order is in — if it’s being picked, packed, in transit, etc. That enhanced visibility is great.

No other 3PLs offer that in my experience. Tracking our costs and how much we’re spending on storage is a lot easier to understand. Off the bat, I liked that I would be able to control multiple warehouses through one page with ShipBob.”

Wes Brown, Head of Operations at Black Claw LLC

4. Reduce dead stock, reshipments, and returns

One-fourth of online customers return 5-15% of what they purchase, and the retail industry loses about $50 billion in the form of deadstock per year.

Dealing with these common inventory challenges can hike up logistics costs, from higher storage costs to returns management (e.g., shipping labels, processing and restocking).

To reduce these costs, there are a few things to consider:

- It’s always important to use inventory forecasting tools to ensure you don’t overstock on product that you may not be able to sell through.

- Make sure your fulfilment process is efficient and is optimised to deliver a high order accuracy rate (to prevent mis-picks that result in returns or packing errors that lead to damages that need to get reshipped).

As far as returns go, 92% of shoppers say they will buy again if the returns process was easy and overall positive. To offset the costs of a return, focus on increasing exchanges. Having a clear returns policy and making the process fast and easy for the customer is essential.

“For reverse logistics, we have also been leveraging ShipBob’s Returns API to automate and streamline our routine RMA processes.

Having ShipBob handle our returns has been a huge help in reducing our daily workload, and the ability to drive this process via API is wonderful.”

5. Get rid of unprofitable products

Whether it’s a slow-selling item or obsolete inventory, having an inventory management system in place can enhance visibility so you can make wise decisions about your product catalogue sooner than later.

Having a process for SKU rationalization also helps you understand if a product is profitable or not. If the costs (and subsequent sales) don’t justify supporting a particular product, then it’s time to discontinue it. After all, deadstock will only block capital and hike holding fees.

One of the best ways to increase inventory visibility is to outsource fulfilment. A 3PL like ShipBob can help you reduce your overhead costs by offering an all-inclusive and affordable rate for access to a large and fully-managed warehousing network

For example, with ShipBob’s omnichannel fulfilment solutions, you can track inventory performance across sales channels and fulfilment centre locations, and get analytics to view fast-moving vs. slow-moving items, your average storage cost per unit, and much more.

How ShipBob can help reduce costs

Partnering with ShipBob is one of the best ways for ecommerce businesses to reduce costs by taking advantage of an international fulfilment presence and storing inventory closer to your customers.

Instead of having to handle all SKU management and logistics on your own, you can outsource it to ShipBob and save time, energy, and money.

ShipBob also helps your online business with tracking distribution metrics and inventory management KPIs so you can easily make cost-conscious supply chain decisions.

Here is how ShipBob can turn your logistics operations into a revenue driver.

Only pay for storage used

ShipBob’s fast-growing fulfilment network helps you save on costs when storing inventory in our fulfilment centres by only paying for the space you need.

Rather than renting a warehouse and hiring/managing a staff, you can store inventory in multiple fulfilment centre locations within our network and track storage costs through the ShipBob dashboard.

Each storage unit is prorated on a monthly basis, so if, for example, you only had inventory in a storage location for half of the month, you will be charged 50% of the cost.

Our end-to-end supply chain solutions also improve inbound and outbound logistics, including warehouse receiving, to establish a more efficient, cost-effective supply chain.

Forecast for lower supply chain costs

If you know what sales volumes to anticipate, you can manage your inventory accordingly to reduce costs.

Forecasting enables brands to make better decisions based on both data and research, from conducting a competitive analysis to predicting future demand based on historical order data, trends, and patterns.

To easily track inventory in real time, ShipBob’s advanced analytics and reporting tool automatically analyses historical data to predict future demand levels and make better decisions. You can get access to data such as:

- Average cost per unit stored

- Average units on hand

- Fulfilment cost per unit

ShipBob also partners with leading inventory management solutions to increase visibility and offer more insight into demand forecasting.

“ShipBob’s Inventory Planner integration allows us to have all of our warehouse forecasting and inventory numbers in one platform.

We can create ShipBob WROs directly in Inventory Planner and have the inventory levels be reflected in our local shipping warehouse and ShipBob immediately.

It also provides forecasting for each individual ShipBob warehouse, so we know how many units we need to ship each week to cover a certain period and also to not run out of stock.”

Marc Fontanetta, Director of Operations at BAKblade

Secure bulk courier discounts

Since ShipBob partners countless businesses from across the world, we are able to secure bulk discounts from shipping couriers like UPS, USPS, FedEx, and DHL on expedited shipping, 2-day shipping, international shipping, other methods.

For US shipments, for example, ShipBob offers faster, affordable 2-day shipping options for qualified customers to meet customer expectations around fast shipping while also reducing shipping costs.

“ShipBob’s advanced software helps us quickly understand shipping costs and how to improve shipping times and costs by being closer to where our customers are.”

Andrea Lisbona, Founder & CEO of Touchland

To learn more about how ShipBob can help you reduce logistics costs, request a quote today.

Cost per unit FAQs

Here are answers to the top questions about cost per unit.

What is the cost per unit?

Cost per unit offers insight into how much it costs to produce a single item, receive new inventory, store it, and fulfil and ship it. By breaking down the cost per unit, you can identify inefficiencies that are driving up costs, therefore reducing profit margins.

How much does it cost to produce one unit?

This will depend on each unique business, but there is a simple formula. Let’s walk through an example: Assume that a business’s monthly spending to produce 100 units of a specialty electronic includes $1,000 on electricity, $5,000 on factory rent, $3,000 on labour, and $4,000 on raw materials. Here is the formula broken down:

- Cost per unit = (Electricity + Rent + Labour + Raw materials) / Number of units

- Cost per unit = ($1,000 + $5,000 + $3,000 + $4,000) / 100

- Cost per unit = $13,000 / 100 = $130

What is the cost per unit if the cost of the product is $1,000?

It would depend on what the fixed and variable costs are. Many ecommerce businesses aim to have a profit margin of 20-40% (though this can be hard to achieve), so if we assume the profit margin is 30% (or $300), then the cost per unit may be around $700 (70% of $1,000).