Table of Contents

** Minutes

How a VAT number affects international trade

The impact of Brexit on VAT regulations

Challenges and common issues related to VAT numbers

How to find a business’s VAT number

Connect AVASK to ShipBob for tailor-made VAT compliance solutions.

How ShipBob can help with international trade and fulfilment

Picture this: your ecommerce brand is thriving, your products are selling quickly, and you’re ready to launch your brand internationally. This is incredibly exciting – but before you can book your first sale in a new country, it’s important to lay some groundwork and stay compliant with international regulations.

One of the most important factors to consider is how you’ll pay taxes in your new sales location. Specifically, you may need to register for a Value Added Tax number, or VAT.

In this article, we’ll cover what a VAT number is, how to obtain one, and how expert partners in international fulfilment and tax compliance like ShipBob and AVASK can help you grow globally with ease.

What is a VAT number?

A VAT number is a valid and unique ID number issued to sole traders or businesses. Governmental authorities use a company’s VAT registration number for value-added tax purposes and to track the business transactions and activities in the country.

VAT numbers consist of a country code prefix and numerical digits, but VAT number formats can vary from country to country. UK VAT registration numbers use the prefix “GB”, followed by 9 digits.

In the UK, VAT numbers are processed and issued by HMRC (or HM Revenue & Customs) which is the national authority on revenue and customs. Upon registration, businesses can start actively trading in the UK, and can begin charging VAT when selling products (if applicable).

The UK offers 3 different VAT rates that merchants can add to products: standard rate (20%), reduced rate (5%) and zero rate (0%). VAT-registered businesses should apply the correct VAT rate depending on the product they are intending to sell.

While most products in the UK are subject to the standard VAT rate, there are some item categories that qualify for the reduced or zero rates. Some zero-rated products include:

- Children’s clothing

- Printed materials (such as books and newspapers)

- Charity sales or donated goods

- Food and drink

Even if you think you know what the VAT rate for your products should be, it’s important to check for exceptions and anomalies. For instance, while most products in the food and drink category are zero-rated, snacks and soft drinks require the standard VAT rate.

How to obtain a VAT number

In order to obtain a valid VAT number and start selling in the UK, businesses must submit an individual application to HMRC, accompanied by all required documentation.

The evidence that must be provided will depend on your company’s country of incorporation. For a UK company, this includes your:

- Company registration number

- Business’s bank account details

- Unique Taxpayer Reference (UTR)

- Annual turnover details

- Self Assessment

- Corporation Tax

- Pay As You Earn (PAYE)

Brands based outside of the UK will need additional or other resources, including a proof of VAT compliance in their own country, passport copies, and proof of UK business activities.

HMRC will then review and process the application. If it is successful, they will issue a VAT number. Your VAT registration certificate will be sent to you in the form of a letter through the mail.

This process can get complicated, but expert partners like AVASK can help you navigate your VAT liabilities and ensure your VAT application is successful. Please contact them via their website to ensure an advisor can connect with you and review your company operations further.

How to remain VAT compliant

Once the application is successful and a valid VAT number is provided, businesses must stay compliant with HMRC’s VAT regulations as long as they are doing business in the UK.

This includes:

- Calculating and including the correct VAT rate in your products’ price so this can be collected and remitted to HMRC.

- Including your 9-digit number on all invoices raised.

- Submitting quarterly filing returns (in accordance with the effective date of registration).

Additional obligations will need to be met if the business is incorporated in the UK.

How a VAT number affects international trade

It’s important that you plan your business’s global expansion in advance, so that you have plenty of time to obtain a valid VAT number and EORI before you import or hold stock in the UK.

The application time will vary from case to case. However, as an estimate, a VAT application generally takes about 10-12 weeks to be completed once all the evidence has been submitted. Use this timeline to arrange your production, international shipping, and customs clearance schedules accordingly.

When you actually start selling your product, remember that VAT is not the same thing as sales tax. While sales tax is charged at the point of checkout, VAT must be included in the product’s price so it can then be collected and remitted to HMRC.

The impact of Brexit on VAT regulations

Brexit officially took place on January 31st, 2020, and the United Kingdom withdrew from the European Union. Consequently, the United Kingdom is not part of the free movement of goods that an EU country may benefit from.

Sellers must therefore remain in compliance with VAT regulations when importing goods to or selling goods in the UK. The necessary steps to be followed depend on factors such as company’s country of incorporation, the stock and value of the goods, and the platform used to conduct the sales. However, VAT and EORI registration are two of the specific tax requirement overseas sellers must met before looking to hold stock in the UK.

You can find more information on specific compliance requirements here.

Challenges and common issues related to VAT numbers

Both large and small businesses may encounter several challenges when navigating VAT compliance. Here are some of the most common issues that businesses run into.

VAT fraud

VAT fraud usually involves the issuance of fake VAT invoices. However, businesses can employ strategies to protect themselves against VAT fraud, such as proactively verifying VAT numbers and reporting instances of VAT fraud on the gov.uk website.

Audits

The purpose of a VAT audit is to ensure the accurate reporting and remittance of the correct VAT amounts in transactions. These audits serve to scrutinize how complete and accurate a business’s VAT records are, and aim to identify any discrepancies or potential non-compliance with tax laws.

Legislation

The intricate nature of VAT legislation across different countries poses a notable challenge for businesses. Staying up-to-date on regulatory changes and seeking professional advice will help your brand keep up as legislation evolves.

Non-compliance

In the event of VAT non-compliance, tax authorities may impose penalties, interest, or assessments on the business. The severity of these consequences depends on the nature and extent of the violations, so it’s incredibly important to adhere to all VAT regulations.

Communication and documentation

Effective communication and documentation of transactions play a pivotal role in ensuring VAT compliance. Incomplete or inaccurate records can lead to complications during audits, so businesses may consider consulting with tax experts to help create and track VAT paperwork.

How to find a business’s VAT number

If you need to find a company’s VAT number, there are a few different ways to do so. his process will depend entirely on where is the company incorporated. You can:

- Look on an invoice from the company.

- Search the Companies House register.

- Check on the company’s website.

- Use the HMRC VAT helpline.

- Contact the company directly.

Connect AVASK to ShipBob for tailor-made VAT compliance solutions.

Growing your brand internationally is exciting, but it’s easy for brands to get bogged down with cross-border complexities. Rather than struggling to figure out sticking points like VAT or international fulfilment and shipping on their own, many brands choose to partner with professionals that know what they’re doing.

AVASK, for instance, assists you in registering businesses for VAT, directly communicating with tax authorities, and optimising processes to ensure strict adherence to VAT regulations. Once you’re all set to sell, leveraging ShipBob as your global ecommerce enablement platform makes it easier to store, pick, pack, and ship your products to and from the UK – and all over the world.

By pairing AVASK’s expert tax services with ShipBob’s comprehensive logistics solutions, you can streamline your brand’s global launch, and make selling in the UK easier.

How ShipBob can help with international trade and fulfilment

Registering for a VAT number is just the tip of the iceberg when it comes to selling in other countries. For your global launch to be a success, you’ll need to have a rock-solid international logistics strategy in place – and ShipBob can help.

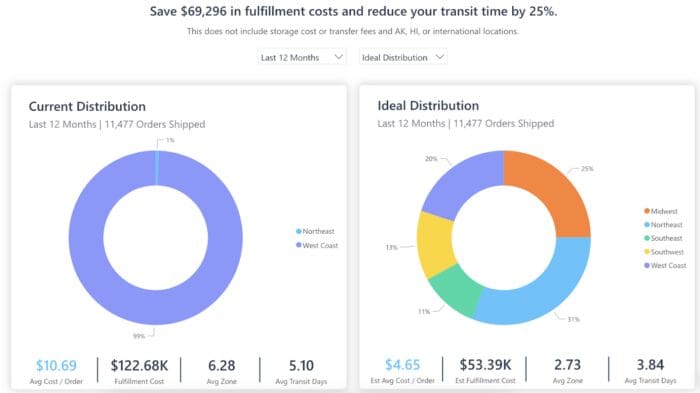

As a global fulfilment and logistics provider, ShipBob has dozens of fulfilment centres all over the world, including locations in the UK, Europe, Australia, Canada, and the United States. Ecommerce brands can leverage these warehouses to store their products within the country they wish to sell in, minimising shipping costs and times while simplifying cross-border duties and taxes.

In every ShipBob location, our teams of fulfilment experts use ShipBob’s proprietary warehouse management software to power picking, packing, and shipping for you. Merchants can monitor both their inventory and fulfilment across all locations through a single dashboard, plus access top-notch data and analytics in real-time for full transparency.

ShipBob even offers a Delivery Duty Paid (or DDP) solution to help brands bypass the complexities of VAT and other taxes and ship to more over 200 countries to convert more shoppers worldwide.

For more information on how ShipBob can simplify your brand’s international expansion, click the button below.

UK VAT number FAQs

Below are answers to common questions about VAT numbers.

Can I claim VAT on purchases made before registering for VAT?

It’s not possible to claim VAT on purchases if the business was still not registered for VAT at the time of sale. It is also not possible for overseas businesses to charge VAT on their products when they are not VAT registered.

How do I know if my business needs to register for VAT?

VAT registration is not universally necessary and varies across countries, with each country enforcing specific rules. In a general sense, businesses are obliged to register for VAT when engaging in taxable sales within a country or if the company stores products within that country.

Voluntary VAT registration is an option that businesses can consider, especially if they wish to reclaim VAT on their business expenses. This strategic decision can have financial benefits for the business.

To navigate the intricate landscape of VAT registration, understanding the specific rules in each country is crucial. Given the complexity of tax laws, seeking advice from a tax professional or accountant familiar with the regulations in the jurisdiction is advisable. These experts can provide tailored guidance based on the unique activities of your business, ensuring compliance.

Can I change my VAT number if I need to?

The VAT number, assigned by the tax authority and unique to your business, is generally not subject to change. However, certain situations may necessitate a change in the VAT number.

One such circumstance involves a change in the ownership of the business. If the original company is no longer operational due to a change in ownership, a new VAT number must be issued. Significant changes, such as reorganization or restructuring (e.g., mergers, acquisitions, or alterations in legal structure), can also lead to the issuance of a new VAT number.

Errors or issues with the existing VAT number represent another scenario prompting a change. Administrative errors or problems associated with the current VAT number might result in the tax authorities reissuing a new VAT number to the business.

It’s crucial to recognise that altering your VAT number can have implications for your business. Therefore, it is essential to adhere to the proper processes. Seeking guidance from a tax professional or accountant is strongly recommended to ensure compliance with the relevant jurisdictions and mitigate potential challenges associated with the change.

How can ShipBob help with international shipping?

Ecommerce brands can take advantage of ShipBob’s dozens of fulfilment centres in the UK, Europe, Australia, Canada, and United States and store their products within the country they plan to sell in, which reduces shipping costs and times for customers in that country. Brands can also leverage ShipBob DDP to attract and convert global customers.